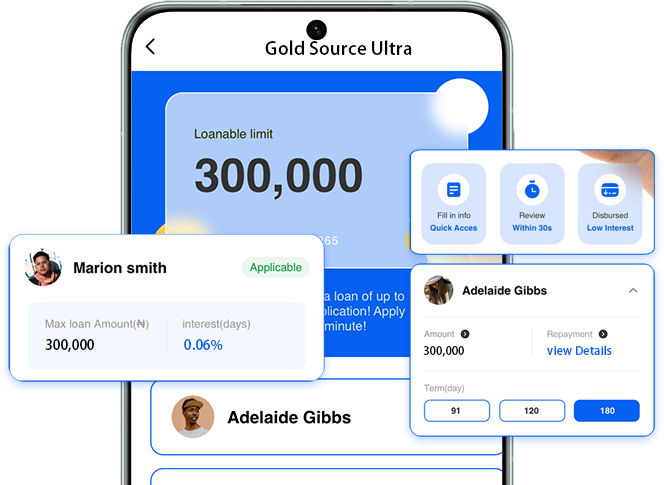

Gold Source Update Highlights

Gold Source Update Highlights

Scope of application

Expanded the loan coverage population, allowing more people to obtain loans

Approval speed

Optimized the review model and improved the review speed

AI customer service

When the manual customer service is on break, we will connect to the AI customer service to serve you

Data security

Adopt a new encryption method to further enhance the security of user data

Our Service Advantages

Our Service Advantages

Company Mission

Company Mission

Rexen Fintech Limited: Leading Fintech Company in Nigeria Committed to providing convenient and efficient loan solutions to Nigerians through innovative technology and professional financial services.

Our mission is to break the limitations of traditional financial services and make financial services accessible to everyone in need. By leveraging advanced financial technology, we aim to simplify the loan process, provide customers with a fast, flexible and transparent loan experience, help individuals and small and micro businesses achieve their financial goals, and promote the development of the Nigerian economy.